The pipe dream of owning a home

What do young workers want?

For a number of years now, we have been told that compared with previous generations, the so- called millennials are seeking out something different- whether it be “purpose” in their jobs, flexibility to maintain a healthy work life balance or co-living arrangements.

Yet, behind all this hype about the millennials, each worker, whatever their age, requires the basic dignity and decency of having a permanent roof over their heads. Nowhere are the problems associated with precarious and low paid work more evident than in the area of housing and the capacity to access affordable housing with certainty of tenure and price, particularly in the main urban areas in Ireland today.

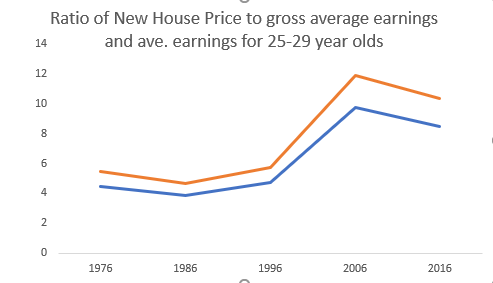

Looking at historical earnings data and income per age data from the CSO along with national house prices from the Department of Housing, Planning and Local Government database, going back almost forty years, it is possible to establish housing affordability by average earnings according to age over time.

This shows that in 1986, a young worker aged between 25 and 29 earning average wages for his or her age cohort was facing house values of 4.7 times their annual income. Twenty years on, that ratio had jumped to 11.92. This ratio obviously fell during the crash but in 2017 it was back up to 11.1.

Source: CSO Census data, National employment survey,EHECS, Dept of Housing, Planning and Local Government and own calculations.

It is no surprise then that 45% of all 25 to 29 year olds owned their house back in 1991, fast forward to 2016 and that share had plummeted to 12%. The situation for those aged 30-35 is not much better, with half of them owning their house in 1991 and the share dropping to just under a third in 2016.

For today’s average young worker, the prospect of being able to buy a house with their own resources anytime soon is remote. For young workers in precarious or low paid work, that prospect is even more distant, the difficulties of affordability compounded by lending rules that require consistency of income. And those prospects become even more remote as with house prices increases five times the increase in real wages.

During the boom years, we know that cheap credit stepped in to meet home ownership demand. But with tight macroprudential rules, what lower paid and middle income young workers do now? Depend on the private rental housing market for their long term housing needs? For a lucky 25% of first time buyers, the impossible becomes possible with the help of a gift from parents to help with their mortgage deposit.

We know from the TILDA project on ageing in Ireland that in their wave three survey over 4000 older (aged 54+) persons, that some 48% of older adults provided financial assistance to their children.

The intended purpose of that gift was not clear, however 2013 research by the Social Market Foundation in Britain on parental transfers to children, found that cash transfers are made in lower income families as well as higher income families. The main difference was that on average lower income families transfer cash across generations for everyday consumption as opposed to strategically planned life events such as the purchase of a house.

No official data on housing downpayments is available here in Ireland but we can rely on the 2017 work of Central Bank economists Jane Kelly and Reamon Lydon that looked at the 2013/2014 wave of the CSO’s household finance and consumption survey. They identify that almost one quarter of first time homebuyers had an inheritance.

For those that can’t access a financial gift, their future is bleak in terms of accessing affordable housing is bleak. Currently, the average worker spends just over 50% of their disposable income on private rent for a one bed apartment in Dublin, leaving them with little or no scope for being able to save for a deposit.

The economics of the housing market and the market control exerted by developers means there will no major glut of housing supply in Ireland any time soon. It is also a misplaced expectation that a simple increase in housing supply will dramatically reduce house purchase prices.

In that context, we need to get away from the mindset of thinking about delivering social, affordable and private housing separately. Any basic understanding of the housing market, and how past crises within it have been resolved, points to the need for the State to become involved in providing market rate and affordable rate rent housing to cross subsidise the social.

The State can and should get involved in building housing. It has the land; the Government itself admits it has 1,700 hectares alone in State agency and local authority control, it has the access to the cheap credit and it has the space within the fiscal rules.

An edited version of this appeared in the Irish Times on 10th, August, 2018.